So, You’re in the Family Business… by Paul Karofsky

Attorney: Since we both have the family’s permission to discuss our thoughts about the company, I wanted to share some of my concerns with you. While the current situation appears stable, I am worried about our client’s son and his long term ability to carry on the family business.

Accountant: I share your concern. I’m not convinced he’s really the best candidate to run the business in the long run. His knowledge in some of the financial areas is low and there are several leadership skills that appear weak. I also think we’ve got a dad who is very eager to retire and may not want to address this problem. And I’m not really certain how to pursue it further.

Attorney: We could call a joint meeting with both father and son, but I’m not confident that would change anything other than possibly alienating us from them.

The attorney reflected what to do next. “I don’t want to be intrusive into the privacy of the family by raising such a potentially sensitive issue. But I am concerned about the long term survival of the company if we don’t help them face it. At least I now have a confirmation of my concern and an ally in their accountant to help encourage the family to address it.”

The company’s accountant, meanwhile, had some anxiety of his own. “I’m considered the company’s most trusted advisor. While I feel an obligation to pursue this for the benefit of the family business, I know it could be difficult for both father and son. I am reluctant to be a cause of pain for both, yet my obligation is to my client, the family business. I also don’t want to be the messenger who gets shot for delivering an unpopular message. Perhaps some joint action with the attorney is the best way to go.”

What’s going on…

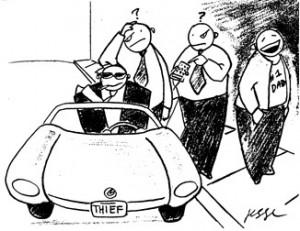

The dilemma that these two professional advisors face is remarkably common. They are struggling with their own obligations to the business vs. their fears about hurting the feelings of family members, and their own stature in the business. Their desire to seek alliance with each other is an effective beginning. Father, in this case, may have his own concerns about the future of the business, but may be averse to address them because to do so is to put at risk his own ability to retire. Perhaps he feels trapped in a lose-lose situation.

The son would probably not be surprised at the conversation between the attorney and the accountant. When younger family members are not qualified to lead the business through the next generation, they generally know it, even though it may require someone else to articulate it. Most likely, the son is reluctant to deal with his own limitations for fear of either disappointing his father or jeopardizing his own future in the business. This son may even feel trapped in his present role with inadequate skills, knowledge or leadership style to attain the same standard of living working in another position. He may even find a sense of relief at having the subject raised by others.

What to do…

Direct input from the company attorney and accountant is important. It is appropriate for the professionals to suggest a joint meeting with key family members to discuss planning for the future. While this may put some relationships in peril, the risk is worth taking for the sake of the survival of the business.

The advisors should encourage the family business to engage in strategic planning. While it is never too late to do this, sooner tends to be easier than later. Within a few years of the entry of the younger generation, it makes sense for family businesses members to formally assess their own desires, strengths and limitations. This can help prevent surprises later on. It is also the time to thoroughly analyze the business opportunities and directions to ensure an appropriate match of management and leadership talent with needs of the company.

A Board of Advisors can also be helpful in encouraging effective succession planning, helping to outline a process including exploring the match between family members’ abilities and the needs of the business.

Criteria for leadership succession need to be established early on, before they are interpreted as exclusionary to particular individuals. These might include criteria around education, experience, and leadership and management style. Candidates can then be evaluated relative to the criteria and, when appropriate, career development plans can be implemented. In this particular business, the son might need some added experience and knowledge in specific areas to render him more competent.

The option of an outside CEO or an interim non-family leader should be considered. This can allow for the proper continuation of the business while family members attain the necessary knowledge and skills to become future leaders.

Increasingly, family members are realizing that leadership succession is an earned responsibility in a family business and not an inherited right. As one family business maintains, “The next president of this company will be the most capable leader in this company, family member or not.”

Paul Karofsky was president of his family’s third generation business. He completed graduate studies at Harvard University doing research in family communication styles. Paul is Executive Director Emeritus of Northeastern University’s Center for Family Business and facilitates its Leadership Development Forum. He is the Founder and CEO of Transition Consulting Group, Ltd and is a frequent speaker and resource to educational institutions worldwide. Paul consults to family enterprises and can be reached at [email protected] or 561-626-1110.

Copyright © 2010 Transition Consulting Group, Ltd. All rights reserved.